Tax-Smart Tips for Your Investment Property

Investing in an investment property is a great way to grow your wealth. However, if you're not careful with the tax obligations surrounding this type of purchase, it can end up costing more than expected.

In this blog post, we'll go over some basic tax-smart tips for your investment property that will help you save on taxes and make your investments as profitable as possible.

We are selling an investment property or main residence

If you're selling an investment property or your residence that you've rented out, keep these things in mind:

- Even if you transfer the property to someone else's name, you may have to pay capital gains tax.

- The difference between your cost base (cost of ownership) and your capital earnings is referred to as a capital gain (what you receive when you sell the property or the market value when you transfer the property).

- A capital loss should be reported in your return if your costs of ownership exceed your capital proceeds, as this amount may limit future capital gains.

- If you claimed a deduction for capital works or depreciation in any income year, these amounts should not be included in your cost base.

- If you have owned the home for more than 12 months and are an Australian resident, you may be eligible for a 50% capital gain tax reduction.

When planning your return, follow these simple procedures.

Rental property owners should remember three simple steps when preparing their return.

1. Include all the income you receive

This includes:

- Arrangements for short-term rentals (for example, a holiday home)

- sharing a room in your house

- any rental income you keep, such as insurance payouts and rental bond money

2. Make sure your expenses are correct.

- Eligibility - You can only claim expenditures for the time your property was rented or for the time you were actively trying to rent it on commercial terms.

- Timing - Certain expenses must be claimed over a period of time.

- Apportion your claim if your property was rented out for a portion of the year or simply a portion of the year if you utilized the property yourself or rented at below-market rates, and so on. You must also divide according to your ownership stake.

3. Keep detailed records to back up your claims

You should maintain track of your rental property's income and expenses, as well as purchase and sale records.

Record keeping tips

Make it a priority to set up an easy-to-use record-keeping system. You can use a spreadsheet or professional software to accomplish this.

Keep track of all transactions during the time you hold the property. Purchase and sale contracts, as well as conveyancing and loan papers, are all included.

To make it easier to store and access your receipts, scan them.

Remember that if you maintain track of all of your income, spending, and efforts to rent out your property, you'll be able to claim whatever you're entitled to.

Tax time is made easier by proper record-keeping

Whether you hire a tax professional to prepare your tax return or do it yourself, you must maintain accurate records for the duration of your ownership of the property.

Keep detailed notes at each point of your journey to ensure you get everything you're entitled to, including:

Buying

- Purchase agreement

- Documents for conveyancing

- Loan agreements

- Purchase price of the property

- Borrowing expenses

Owning

- Proof of rental revenue earned

- All of your costs

- Periods of private use by you or your friends

- Periods the property is used as your main residence

- If you refinance your home, you'll need loan documents

- Attempts to rent the property out

- Capital improvements

Selling

- Sales agreement

- Documents of conveyancing

- Property sale commissions

- Capital gain or loss computation

Calculate your deductions for capital works

Certain construction costs for a rental property can be deducted as capital works. Your capital works deductions, however, cannot exceed the building costs.

The type of construction and the date construction began, decide the percentage of deduction and the number of years you can claim it for.

Limits to claiming capital works deductions

You can only claim a deduction if you used your rental property for income-producing purposes during the year. You are not eligible to make a claim for the time you utilize the property for personal reasons.

Example: How to calculate capital works deductions from the start of construction?

Meg bought a $300,000 rental house on March 1, 2020, and promptly rented it out. Meg acquired a quantity surveyor's report, which stated:

- The property's construction began in February 2003.

- A private townhouse is located on the site.

- The building was finished in November 2003.

- The townhouse was constructed by a developer.

- The townhouse was expected to cost $200,000 to build.

Meg claims a capital works deduction for her rental home in her 2020 tax return, based on the quantity surveyor's estimate of construction expenses. However, she only claims a deduction for the time her property was available for rent throughout the year (1 March to 30 June 2020). Because the development of her residential property began after September 15, 1987, she claims a discount of 2.5 percent.

Her annual capital works deduction was calculated as follows:

- $200,000 × 2.5% (see note)=$5,000

- For varied rates of reduction, look at the start date of construction.

- Because she only used the property for income-producing purposes for 122 days in 2020, her claim for 2019–20 was computed as follows: $5,000 × (122 ÷ 366) = $1,667

End of example

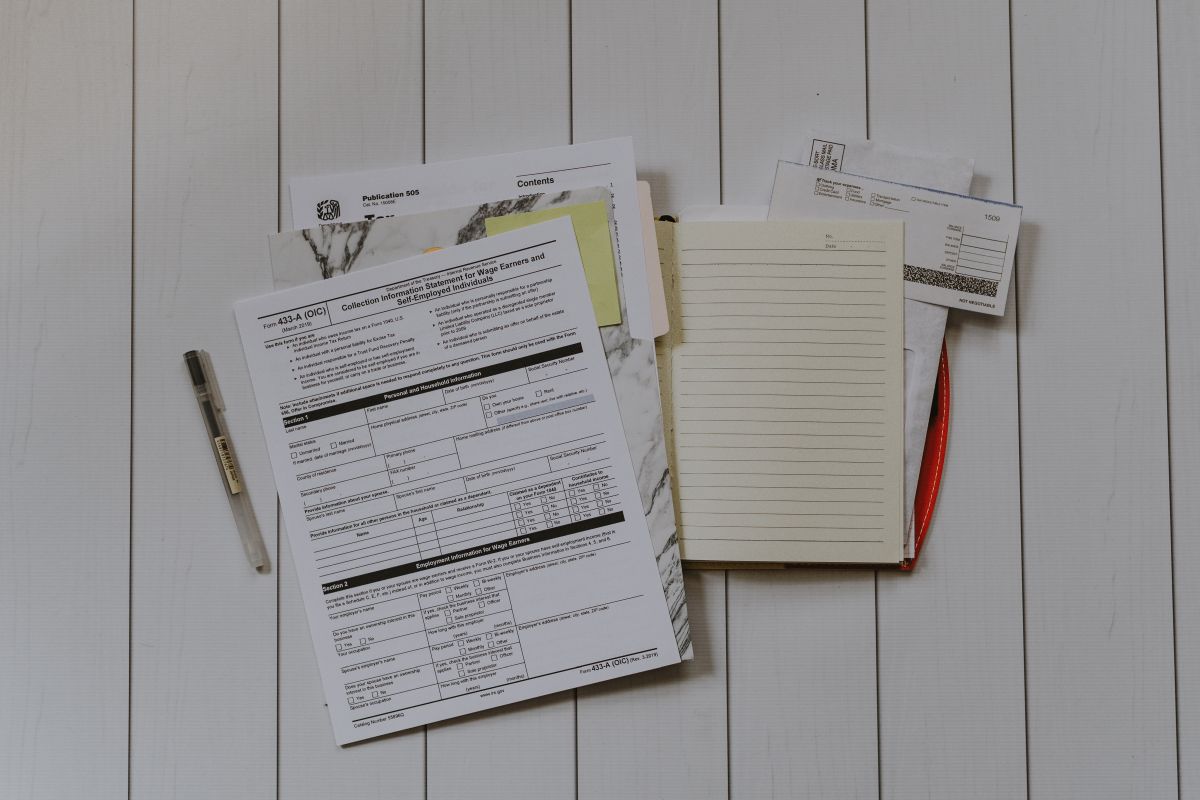

What you'll need to figure out your claim

As a general rule, you can claim a capital works deduction for the cost of building for 40 years after it was completed.

However, you must have all of the following to be considered eligible:

- details of the type of construction

- the date construction commenced

- the date construction was completed

- the construction cost (not the purchase price)

- details of who carried out the construction work

- specifics of the time the property was used for income-producing purposes during the year

For capital gains tax purposes, capital works expenses are included in the cost base of your property. As a result, if you claim a capital works deduction, you must factor this into your capital gain or loss calculation.

If you can't figure out the exact building expenses, you can get an estimate from a quantity surveyor or another certified third party. The fees you paid to get this estimate can be deducted from your taxes.

See Cost base modifications for capital works deductions for further information on how capital works deductions affect the CGT cost base.

Engaging a property advisor is crucial for first-time homebuyers to navigate the buying process

The different types of construction and when they commenced

Construction work must begin after the data relevant to that type of construction is in the table below to be eligible for a capital works deduction.

The amount you can deduct for building costs is determined by the type of construction and the start date. Depending on the type of building, this table indicates the deduction rate and the time period over which you can claim the deduction.

Construction cost

You must show proof of building costs in one of the following ways:

- precise documents that show the construction costs, such as receipts

- an appropriately qualified person wrote a report.

The following items are not allowed to be utilized as construction costs:

- the purchase price of the building and land

- the insured cost

- the replacement cost.

If you were the owner-builder

The value of your contribution to the works does not count toward the construction cost if you built it as an owner-builder. This comprises:

- your labour and expertise

- any notional profit element – that is, an amount you might consider as a profit margin on the construction cost.

Obtaining the construction information

You should make sure you keep records that detail the construction costs, whether:

- you are in charge of the construction

- you hire a contractor to do the project.

Assume you don't keep track of the construction expenditures (for example, where the vendor did not provide them). In that situation, you'll need to get this information from either the prior owner or a qualified third party. This might be:

- quantity surveyor

- clerk of works, such as a project organiser for major building projects

- the supervising architect who approves payments at project stages

- builder with experience estimating construction costs of similar building projects.

In the year you pay it, you can claim a deduction for the costs of acquiring this information from a suitably competent person.

A schedule of depreciable assets can be included in quantity surveyor reports (capital allowances).

You can deduct the loss in value of depreciating assets in a rental property separately:

- if you bought the rental property before 7.30 pm (AEST) on 9 May 2017 – it doesn't matter whether the property was brand new or not

- if the depreciating asset is brand new – purchased at or after 7.30 pm (AEST) on 9 May 2017

- as part of your brand new property

- that you subsequently bought for your existing (non-new) property

- if you bought the property on or after 7.30 pm (AEST) on 9 May 2017 to provide residential accommodation, the property has to be brand new or substantially renovated if no one previously claimed any depreciation deductions on the asset, and

- either no one lived on the property when you acquired it, or

- if anyone lived in the property after it was built or renovated, you acquired it within six months of the property being built or renovated

- the property does not provide residential accommodation, or

- the asset is used in carrying on a business, or

- the entity claiming depreciation is a:

- corporate tax entity

- superannuation plan other than a self-managed superannuation fund

- public unit trust

- managed investment trust

- unit trust or partnership whose members are any of the entities in this dot-point.

You should give the buyer a capital works notification that includes enough information for them to calculate their capital works deduction if you both:

- are a vendor disposing of capital works begun after 26 February 1992

- were able to claim a deduction for those capital works.

The notification must be sent within six months of the income year in which the property is sold or within a longer-term granted by us.

The vendor who is selling the property does not have to provide the purchaser notice if the property is not used for rental income. The buyer can get an estimate in this circumstance, usually from someone who is adequately qualified.

Remember to obtain your construction costs report as soon as possible, as these reports can take a long time to prepare. If you obtain a report after you lodge your tax return, you can amend your tax return by a certain later date. However, there is a time limit on amending tax returns for which we have already issued a notice of assessment.

Top 10 suggestions for avoiding typical tax blunders for rental property owners

Avoiding these ten frequent blunders will save you time and money whether you use a tax agent or file your tax return yourself.

Co-owned property expenditures and income distribution

If you share ownership of a rental property with another person, you must report rental income and expenses based on your legal ownership of the property. As joint tenants, your legal interests will be split equally. However, as tenants in common, your ownership interests may differ.

Make sure your property is genuinely available for rent

Your property must be genuinely available for rent to claim a tax deduction. This means:

- You must be able to demonstrate that you are serious about renting the house.

- Set the rent in line with similar properties in the region and advertise the property so that someone is likely to rent it.

- Avoiding too high rental rates.

Initial repairs and capital enhancements must be done correctly

Ongoing repairs that are directly related to wear and tear or other damage caused by you renting out the property can be claimed in full in the same tax year that the amount was incurred. Repairing the hot water system or a portion of a damaged roof, for example, can be subtracted right away.

Initial repairs, such as replacing broken light fixtures and restoring damaged floorboards, are not immediately deductible. Nonetheless, a capital works deduction can be claimed across several years. These costs are also utilized to calculate your capital gain or loss when you sell the property.

Replacement of a complete building, such as a roof, when just a portion of it is damaged, or renovation of a bathroom, is considered an improvement and is not immediately deductible. These are, however, construction charges that you can deduct at 2.5 percent each year for the next 40 years from the date of completion.

Let's say you need to replace a removable, broken item in your home, and it costs more than $300. (for example, replacing the entire hot water system). The cost must be discounted over several years in this situation.

Claiming borrowing expenses

The deduction is spread out over five years if your borrowing costs exceed $100. If they are less than $100, you can claim the entire amount in the same tax year as the expense. Loan setup fees, title search fees, and the price of drafting and filing mortgage documents are all included in borrowing costs.

Claiming purchase costs

You cannot deduct any expenses related to the purchase of your home. These include stamp duty and conveyancing fees (for properties outside of the ACT). If you sell your home, however, these expenses are utilized to calculate whether you must pay capital gains tax.

Claiming interest on your loan

If you take out a loan for your rental property, you can deduct the interest. However, if you use some of the loan money for personal reasons, such as buying a boat or going on vacation, you won't be able to collect the interest. Only the portion of the interest that is related to the rental property can be claimed.

Correcting construction expenses

Certain building costs, including extensions, alterations, and structural improvements, can be claimed as capital works deductions. As a general rule, you can deduct 2.5 percent of the construction cost for the first 40 years after the construction is completed.

If someone else claimed capital works deductions on your property before you, ask them to furnish you with the information so you can calculate the deduction you're entitled to. If you can't get such facts from the previous owner, a trained professional who can estimate previous construction expenses can help.

Getting the most out of your expenses

If you rent your rental property to family or friends for less than market rent, you can only deduct the amount of rent you received for that period. Furthermore, you cannot deduct expenses when your family or friends stay for free or for personal purposes.

Keeping accurate records

To claim what you're entitled to, you'll need proof of your income and expenses. When you sell your rental property, you may be subject to capital gains tax. So keep records for the entire time you hold the property and for five years after you sell it.

When selling, get your capital gains properly.

You will either make a capital gain or a capital loss when you sell your rental property. This is the difference between what you paid for the property when you bought it and what you got when you sold it.

Depreciation and capital works must not be included in your expenditures because they have already been claimed as a deduction against rental revenue obtained from the property. If you make a capital gain during the year, you must report it on your tax return. If you make a capital loss, you can carry it forward and subtract it from future capital gains.