Taxation in Australia & the Moral Compass

There is a vast variety of taxation systems in use across the globe, and each one has both advantages and disadvantages. In this article, we will discuss the taxation system that is in place in Australia, as well as how it affects both individuals and corporations. In addition to that, we are going to investigate the role that morality plays in the calculation of tax rates and exemptions.

Taxation is among the most essential components of life in a democratic society to take into consideration. It is the means by which we finance the public goods and services that we all require and make use of. But how do we determine which taxes to impose and how much revenue to collect from them? In this article, we will examine some of the factors that are taken into account when formulating Australia's tax policy, and we will ponder the question of whether or not our current system is ethical and just.

Taxation is something that is handled differently in every nation, and Australia is no exception to this rule. In this essay, we take a look at the tax system in Australia as well as how it operates. We also discuss how taxation can be perceived as a moral issue, with some individuals contending that it is unethical to take people's money against their consent, which is an argument that we examine. In conclusion, we discuss the question of whether or not we believe the tax system in Australia is equitable.

Taxes are something that must be dealt with by everyone, yet few people understand them very well. Due to the complication of Australia's tax system, it can be challenging to determine what taxes you are responsible for paying and how much you ought to pay. In this article, we will examine the fundamentals of Australian taxes and investigate the ways in which our nation's tax system reflects the moral principles that we uphold as a whole. In addition to this, we'll have a conversation on some of the current debates around taxes in Australia, and we'll share our perspectives on the significance of taxation.

If you're like the majority of people, hearing the words "taxation in Australia" probably doesn't make you feel very strongly about the topic in either direction. What if, however, I were to tell you that the topic of taxation is one of the most morally contentious debates in our society? It is a subject that gives rise to a wide range of problems concerning what is good and wrong, as well as fairness and equality.

In this article, we'll take a more in-depth look at taxes in Australia, including what it is, how it operates, and the areas where people typically argue on the legitimacy of the system. It is my hope that by gaining a deeper comprehension of taxation, we will be able to gain a deeper comprehension of our own moral compass with regard to this complicated matter.

The tax system in Australia might be difficult to understand. It is essential, however, to keep in mind that the majority of the essential governmental services on which we rely are funded by our taxes. These services include everything from social assistance and healthcare to education and infrastructure. The question then is: how can we ensure that our tax system is ethical and fair? This is when having a strong moral compass can be helpful.

There is no shadow of a doubt that Australia's taxes system is one of the most complicated in the world. But what ethical principles guide the creation of our fiscal regulations? Andrew Leigh, a law professor at the University of New South Wales (UNSW), recently published an article in which he investigated this subject.

The concept of "tax morality" is investigated in Leigh's paper, which also poses the question of whether or not individuals who are able to pay higher tax rates ought to do so. This is an essential subject to think about in light of recent incidents involving prominent Australians who avoided paying taxes through various tax evasion methods.

Taxation and morality are topics that are occasionally discussed in Australia. Recently, there has been a lot of heated debate over the possibility of imposing a new tax on those with high incomes and whether or not to do so. This has had me wondering about the ethics of taxation and where individuals get their ideas on the subject from.

We wanted to learn more about this topic, so we decided to inquire with locals about their perspectives on the tax system in Australia and whether or not they believe it is equitable. Should there be a higher tax rate? Or a decrease in taxation? And what causes us to think in this manner? After all, taxation is a necessary component of society; without it, our economy would come to a complete and utter halt. Therefore, let's take a more in-depth look at the system of taxation used in Australia and see if we can come up with some answers to the problems raised above.

Let's get started!

The Moral Compass

The topic of taxation in Australia was the focal point of the ABC program "Moral Compass." The topics of tax planning and tax evasion took up a significant portion of the conversation.

During the course of the conversation, a repeat of Kerry Packer testifying before a government Senate inquiry into the print media, during which he made the following comments, was shown on the screen.

Mr. Packer muttered under his breath as he used a teaspoon to stir the tea in the beautiful parliamentary china cup he was drinking from. "I don't know anybody who doesn't minimise their tax," he said. "I am in no way, shape, or form attempting to avoid paying my taxes.

Obviously, I'm trying to pay as little tax as possible. Everyone in our country needs to have their heads examined if they don't minimize their tax liability. I can tell you as a representative of the government that you are not spending it very well and that additional funds should be contributed."

Also commenting on what Bill Gates had to say around a year ago was Professor Fred Hilmer who said:

"I am happy to pay the tax, but unless all rivals are treated similarly by the tax system for me to make voluntary tax payments, I would not think to impair the success of Microsoft," Bill Gates once said. "I am delighted to pay the tax."

One of the issues that you need to ask is why the legislation is so lengthy and intricate, as well as who the benefits of this structure are intended for. One piece of the puzzle can be found in the very individuals who, according to the government, are exploiting the system in an unethical manner. However, a significant portion of the issue is caused by the fact that the legislation enacted by the government, and not by corporate Australia, enables businesses to pay little or no tax in relation to their profits.

We would all like to see legislation that is not only effective but also implemented with consideration for the long term future of this country rather than legislation that is just enacted with the intention of bolstering the electoral chances of the current government at the upcoming election. In a similar vein, the government of the opposing party has a responsibility to support beneficial outcomes for all Australians and to avoid being unfavorable to all initiatives.

The purpose of the taxation system is not to provide social assistance; rather, it is to generate sufficient revenue for the government to be able to carry out its long-term plans for the nation.

A venture capitalist and philanthropist by the name of Mark Carnegie made the point that "the tax system should be a simple system with no loopholes." I feel it would go a long way toward solving many of the problems that are occurring now, and I agree with the statement.

If we as a nation are of the opinion that certain members of our society are in need of medical attention, then the issue of how to pay for such medical attention should be addressed by legislation separate from the legislation governing revenue. The incorporation of social concerns into the legislative framework governing taxation results in a significant increase in the complexity of the system, which in turn facilitates the seeming avoidance of taxation.

And these concerns will continue to exist up until such time as Parliament makes the effort to simplify the tax code, and Kerry Packer's statements are still as pertinent today as they were 24 years ago.

Because this will not be achieved without the cooperation of all members of Parliament, regardless of party, who are looking out for the long-term benefit of Australia, this is not an issue that is just for the government that is currently in power, and we will still be making the same comments about it in another 25 years.

Professional And Ethical Requirements Set By The APESB

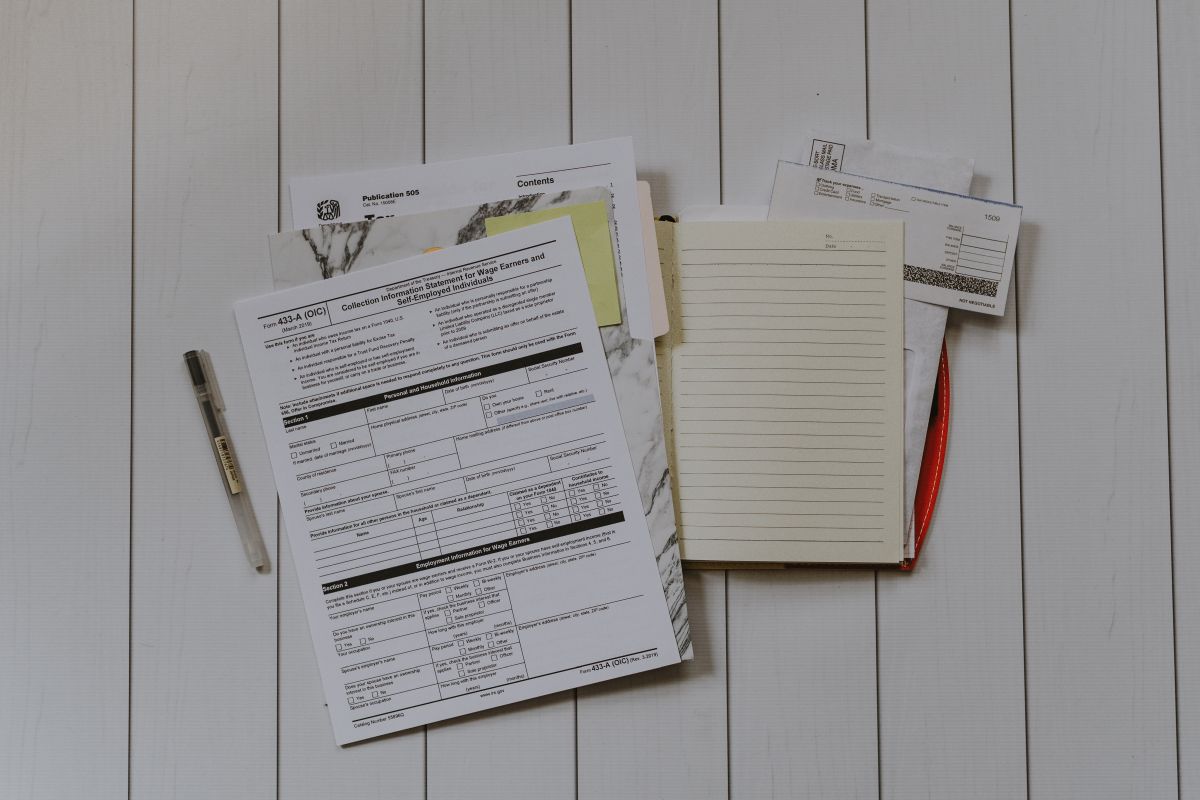

1. APES 215 Forensic Accounting Services

1. Objective

Members who offer forensic accounting services are subject to the mandatory requirements and recommended practices that are outlined in the APES 215 Forensic Accounting Services standard.

2. Scope and application

The first version of APES 215 went into effect on July 1, 2009, and subsequent versions were amended in December 2013 and December 2015. The updated norm will take effect for engagements or assignments that begin on or after April 1, 2016, whichever comes first.

When providing forensic accounting services, members in Australia are required to comply with the Standard's mandatory requirements in order to maintain their membership. In a similar vein, members located outside of Australia are obligated to comply with the required provisions of APES 215, unless doing so would be contrary to the laws or rules of their home country.

It is possible that certain professional operations will not initially be classified as forensic accounting services but will eventually take on this designation at a later time. As soon as a particular endeavour transforms into a forensic accounting service, it is required to comply with the standard requirements.

In a similar vein, a forensic accounting service that is not currently an expert witness service might transition into providing such services in the future. In the event that this takes place, beginning at that point forward, the requirements of the standard on the provision of expert witness services must be adhered to.

3. Fundamental responsibilities of members

When offering services related to forensic accounting, members of APES 215 are obligated to observe and comply with their obligations related to the public interest.

In addition, the Standard serves as a gentle reminder to members of their professional responsibilities as outlined in the APES 110 Code of Ethics for Professional Accountants (Code) in the following areas:

- Section 100 – introduction and fundamental principles

- Section 130 – professional competence and due care

- Section 280 – objectivity – all services

- Section 220 – conflict of interest

- Section 110 – integrity

- Section 140 – confidentiality

- Section 120 – objectivity

When members perform forensic accounting services that necessitate independence or when they pretend to be independent, they are required by APES 215 to conform with the definition of independence. This responsibility is imposed on members. When a forensic accounting service is also an assurance engagement, the Code's Section 290 addresses the issue of independence.

4. Expert witness service

Members who provide services as expert witnesses are subject to the mandatory responsibilities imposed by APES 215. It also requires members who give expert witness services to communicate many components in any report they produce, subject to any legal requirements or restrictions that may be applicable.

In accordance with APES 215, members are reminded that their primary responsibility is to the court while acting in the capacity of an expert witness, and that they must provide assistance to the court in a manner that is both objective and impartial. A member has the responsibility to refrain from advocating on behalf of a party and must make it apparent to the court when an issue is outside of the member's area of expertise.

The information that a member is required to convey in an expert witness report is a mandatory requirement of the standard, and among other components, it contains the following:

- instructions, either verbal or written, obtained;

- the restriction imposed on the breadth of the task carried out;

- whether any of the member's opinions, results, or conclusions are not founded on their specialized knowledge;

- any relationships that the member, the member's firm, or the member's employer has with any of the parties to the proceedings that may compromise compliance with the fundamental principles of the Code or the member's paramount duty to the Court, as well as any appropriate safeguards that have been put into place;

- the essential data and presumptions upon which opinions or other forms of evidence are founded;

- any limitations on how the report can be used, as well as a declaration that the expert witness service was carried out in accordance with the Standard.

For details regarding the following, please refer to the standard:

- both in terms of scope and applicability;

- definitions;

- duties that are fundamental to membership;

- professional engagement matters;

- services of experts to testify in court;

- information that is inaccurate or deceptive as well as shifts in viewpoint;

- quality control;

- fees charged by professionals;

- facts, hypotheses, and personal opinions;

- a decision tree that will indicate the kind of forensic accounting service needed;

- services that are instances of forensic accounting work.

2. APES 225 Valuation Services

1. Objective

Members who perform valuation services are subject to the necessary requirements and recommended practices outlined in APES Standard 225, "Valuation Services." As a consequence of this, the most important professional obligations that are imposed by this standard are the mandated requirements for valuation reporting and documentation.

2. Scope and application

The APES 225 standard was initially implemented on January 1, 2009, and subsequent updates occurred in May 2012, December 2015, and March 2018. The updated standard will take effect for valuation engagements or assignments that begin on or after July 1, 2018, and it will apply retroactively.

When its members carry out a valuation engagement or assignment in Australia, they are obligated to comply with the organization's mandatory requirements. The extent of the Standard must be adhered to by members located outside of Australia, provided that the members do not violate any of the applicable local laws or regulations.

3. The fundamental obligations of the members

When carrying out a valuation engagement or assignment, members are required by APES 225 to observe and comply with the public interest requirements that are associated with their membership.

In addition, they are responsible for adhering to Section 100: Introduction and Fundamental Principles of the APES 110 Code of Ethics for Professional Accountants (the Code), as well as any pertinent laws or regulations.

In order for members to be in compliance with their professional obligations, which were created in accordance with the Code, the Standard demands that:

- Section 100 – public interest

- Section 130 – professional competence and due care

- Section 140 – confidentiality

- Section 210 – professional appointments

- Section 220 – conflicts of interest

- Section 280 – objectivity – all services.

Examples of what constitutes the provision of a valuation service

In order for a valuation service to continue operating, the three requirements listed below must be met:

- The member has to be hired or given the responsibility of doing a valuation.

- Utilizing various valuation approaches, valuation methods, and valuation procedures, the member is required to arrive at an estimate of the worth of a business, business ownership interest, security, or intangible asset;

- To get a value report from the member, you must either hire them or give them the task (written or oral).

Members should refer to Appendix 1 of APES 225, which contains a diagrammatic summary of what makes up a Valuation Service as well as 23 instances that explain what makes up a valuation service and what does not make up a valuation service.

4. Professional engagement and other considerations

Members are reminded of their professional responsibilities to document and explain the terms of engagement under APES 305 Terms of Engagement. This requirement is outlined in APES 225.

If a member uses the services of an appropriately qualified third party, that member is prohibited from disclosing either the opinion or the name of the third party without first obtaining permission from the third party. The one and only exception to this rule is where there is a requirement to disclose information under the law.

5. Reporting

APES 225 details the components that members must incorporate into their valuation reports when presenting them to clients or employers. Written reports are often issued by members of public practices in the majority of cases.

On the other hand, the norm permits members who are engaged in public practice to issue oral reports under specified conditions. In situations in which the valuation report is conveyed verbally, the member of the public practice is obligated to keep a record of the oral communication and to explain why the valuation report was delivered verbally.

In addition to the aforementioned, the standard also advises that members in public practice include extra information in the valuation report. This additional information can be in the form of a summary of important financial and industry facts.

For details regarding the following, please refer to the standard:

- reporting requirements

- professional fees.

- use of a third-party expert

- definitions

- the three types of valuation services

- professional independence

- confidentiality

- documentation

- use of a glossary of business valuation terms

3. APES 310 Client Monies

1. Objective

Members in public practice who deal with client monies or who act as auditors of client monies are required to comply with the mandatory requirements and guidance outlined in APES 310 Client Monies. This course also provides this information.

2. Scope and application

APES 310 went into force in December 2010, and since then, it has undergone multiple revisions, the most recent of which took place in November 2019.

Members in public practice in Australia are required to adhere to the revised standard's mandatory requirements whenever they deal with client monies or act as auditors of client monies. The revised standard went into effect on January 1, 2020, and is effective for engagements beginning on or after that date.

For APES members who are engaged in public practise outside of Australia, the rules of APES 310 must be adhered to, provided that the members do not violate any of the applicable local laws or regulations.

For instance, the criterion is not applicable in situations in which a member of a public practice organization serves in a trustee capacity or under a power of attorney. Under these conditions, the member is not acting in the capacity of a customer to the organization.

The Standard is composed of two distinct sections:

- Part A: the professional responsibilities of a member in public practice who works with the monetary assets of clients; Part B:

- Part B focuses on the professional responsibilities that an auditor of client funds must fulfil.

3. APES 310 definition

Monies include:

- cash;

- currency from another country;

- any negotiable instrument;

- any security where the title can be transferred upon delivery (such bills of exchange and promissory notes, for example), including delivery by electronic funds transfer.

Client monies are defined as any monies (in whatever form) coming into the control of a member in public practice or any of the member's personnel that are the property of a client. This definition includes monies to which the member or the member's personnel do not have a present entitlement. Client monies can come from a variety of sources.

4. Part A obligations

Obligations include:

- general guidelines that should be adhered to;

- establishment of accounts of trust;

- dealing with customer funds, including retaining, receiving, and disbursing customer funds;

- documentation.

5. Part B obligations

In Part B, the responsibilities of an auditor of a member's compliance with the standard are laid out in detail, and an example audit report tailored to this kind of interaction is also provided. Auditors of client funds are responsible for ensuring compliance with APES 310, as well as any other applicable auditing and assurance requirements, as well as the Code.

6. Primary duties and obligations of all members

Members in public practice who deal with client monies or act as auditors of client monies are required by APES 310 to conform with the APES 110 Code of Ethics for Professional Accountants (the Code) in regard to the following areas of responsibility:

- Compliance with the Code, as outlined in Section 100;

- Professional Competence and the Obligation to Use Due Care, Section 113;

- Confidentiality, as specified in Section 114;

- Conflicts of Interest are addressed in Section 310.

Obligations of a member in public practice who interacts with the money of clients from a professional standpoint

The following are some of the general rules surrounding the handling of monetary transactions involving clients:

- accordance with Section 350 of the Code, which deals with the Custody of Client Assets;

- dealing with client funds must always be done through a client bank account or a trust account, and must always be done in accordance with the customer's agreement and instructions.

- be responsible for the management of all client funds and maintain a separate account for client funds apart from the member's other funds;

- set up the required internal controls and procedures with regard to the management of trust accounts and bank accounts belonging to customers;

- not derive any financial profit from dealing with customer funds without first obtaining the client's prior written authorization;

- In accordance with the provisions of Section 330 of the Code, titled "Fees and Other Types of Remuneration," you may only collect professional fees for managing client funds.

- not to receive or pay into or disburse out of a trust account or a client bank account, if the member suspects, on reasonable grounds, that the funds were obtained from illegal activities or are to be used for illegal acts, or that dealing with the cash in any other manner is prohibited;

- refrain from engaging in any activities that could be seen as money laundering, including the use of criminal proceeds or funding for terrorist organizations;

- comply with Section 360 of the Code, which is titled "Responding to Non-Compliance with Laws and Regulations (NOCLAR)," whenever the entity in question comes across or becomes aware of situations in which there is non-compliance or suspected non-compliance with laws and regulations.

Refer to the APESB for guidance on:

- Exemplification of a bank letter used to establish a trust account;

- Accountants who work professionally and an information sheet for trust accounts.

More people than just members running trust accounts are on the hook for fulfilling APES 310's responsibilities. The Standard applies in situations when a member or any of the member's employees has the ability to authorize a transaction involving client cash. Some examples of such situations are as follows:

- storing, receiving, or disbursing cash belonging to customers;

- having the authority to handle monetary transactions with customers;

- any money that comes into the member's control but to which the member does not at the current time have an entitlement.

7. An examination of a member's compliance with this criteria who is engaged in public practice

In order to provide increased protection for customers, APES 310 mandates that members who handle, receive, or spend money belonging to customers undergo annual audits.

Members who opened trust accounts or obtained authority to transact in client monies after 1 July 2011 have the ability to choose the applicable year-end date within 12 months of the month-end following the opening of the trust account or obtaining the authority to transact in client monies. This date must be chosen within 12 months of the month-end following the opening of the trust account or obtaining the authority to transact. Once the year-end date has been selected, it is not possible to alter it without first receiving permission from CPA Australia.

Members who opened trust account accounts or obtained authority to transact in client monies prior to July 1, 2011 are required to comply with the audit requirements of APES 310 within three months of the applicable year-end date, which is March 31 of each year. This deadline is in place to ensure that members' compliance with the audit requirements.

A member in public practice is required to ensure that the member's compliance with the requirements of the Standard is audited annually within three months of the applicable year-end date, and the member is required to appoint another member in public practice as auditor of client monies to perform the audit. In addition, the member is required to ensure that the compliance audit is performed within three months of the applicable year-end date.

Members who no longer handle client funds are obligated to guarantee that compliance with APES 310 is audited within three months of their last transaction involving client funds.

Please take note that members in the state of Queensland are subject to different laws.

8. The professional responsibilities of an auditor for determining whether a member in public practice is in compliance with this standard

A member in public practice who performs audits of client cash is needed to comply with the following requirements:

- carry out the relevant assurance engagement and compile the auditor's report in accordance with the applicable auditing and assurance standards;

- conform with the requirements outlined in Part B of the Code, which pertain to independence for assurance engagements other than audit and review engagements;

- upon becoming aware of a shortfall in the amount of money owed to a customer, the member is required to notify the member's professional body of the shortfall within five business days;

- report to the member's professional body within ten business days of being aware of any substantial failure committed by a member, uncorrected error reflected in a statement issued by a financial institution, or circumstances where client money have not been transacted or maintained in accordance with this standard; report within ten business days of becoming aware of any material failure committed by a member; report within ten business days of becoming aware of any uncorrected error reflected in

- Keep pertinent working materials for a period of at least seven years;

- When an auditor resigns from their post or is removed from their duty as an auditor of client cash, it is important to think about alerting the auditee's professional body.

Within fifteen business days following the conclusion of the assurance (audit) engagement, the auditor is required to send a copy of the modified auditor's report to the General Manager of Professional Conduct at CPA Australia. This must take place.

Even though unmodified reports are not required to be lodged, they must still be maintained, and the Best Practice Program may look at them if they meet certain criteria.

For details regarding the following, please refer to the standard:

- For details regarding the following, please refer to the standard:

- definitions;

- public interest;

- conformity with international pronouncements;

- professional competence and reasonable care;

- confidentiality;

- establishing a bank account for trust;

- dealing with the money belonging to customers;

- distribution of client monies;

- documentation.

4. APES 315 Compilation of Financial Information

1. Objective

In APES 315, "Compilation of Financial Information," members in public practice who take on compilation engagements are subject to mandatory requirements and given guidance on how to perform their work. The Standard also supports the application of the standard to engagements in order to assemble information that is not financial.

2. Scope and application

The initial version of APES 315 went into effect on January 1, 2010, and subsequent revisions took place in February 2015 and March 2017. When members in public practice in Australia generate financial information, they are required to conform to the organization's mandatory requirements as a condition of membership.

Members who are engaged in public practise outside of Australia are required to comply with the provisions of APES 315 so long as doing so is not prohibited by the rules and regulations of the host country. The updated Standard is applicable to engagements that begin on or after July 1, 2017, whichever comes first.

Activities such as the preparation of a tax return and financial information prepared exclusively for inclusion in the tax return, the analysis of data provided by the client in order to report to the client, and the relaying of information to the client without collecting, classifying or summarizing the information, and assurance engagements are examples of activities that are not covered by the standard and do not fall under its purview.

3. The fundamental obligations of the members

When carrying out a compilation engagement, members are required by APES 315 to observe and comply with the public interest requirements that are associated with their membership. Additionally, members are reminded of the professional obligations that are outlined for them in Section 130 of the APES 110 Code of Ethics for Professional Accountants, which is titled "Professional Competence and Due Care."

According to APES 315, independence is not necessary to accept a compilation engagement; nevertheless, when the member is not independent, disclosure must be included in the compilation report.

4. Procedures

A adequate awareness of the client's business, its operations, as well as accounting principles and practices, is required of the member under APES 315, however this understanding can vary depending on the terms and nature of the compilation engagement.

The member is not required to carry out procedures such as verification of relevant matters or information, assessment of internal controls, and assessments of the reliability, accuracy, and completeness of the information provided unless the member has reason to believe that the information supplied by the client contains a misstatement.

Let's say the customer balks at providing any more information that would be needed to clarify any potential errors in the statement. If this is the case, the member deciding whether or not to continue acting for the customer should consult the firm's policies and procedures, which were formed as a result of APES 320 Quality Control for Firms.

5. Providing information regarding a compilation assignment

When certain conditions are met, a member is required to produce a compilation report:

- The name of the member or the firm is associated with the accumulated financial information;

- There is a possibility that an external party other than the user for whom the information was intended may be able to associate the member with the assembled financial information, and there is also the possibility that the member's level of engagement with the information will be misconstrued;

- It is possible that the user's intended purpose does not comprehend the nature and breadth of the member's involvement;

- The information that has been collated is required because of a law or rule that is applicable, or it is required to be publicly filed.

When a member compiles financial information for a client for the client's internal use only, the member should issue an accountant's report disclaimer and include a reference on each page of the compiled financial information to the fact that the information is restricted for internal use only and should be read in conjunction with the accountant's report disclaimer. This is required in situations where the member compiles financial information for a client.

In the event that a member publishes a compilation report regarding financial statements that were prepared in accordance with a regulation or a contract, that member is required to either explain the purpose for which the financial statements are prepared within the compilation report or make reference to a note within the financial statements that contains that information.

The following are required components that must be included in a compilation report:

- a statement from the addressee confirming that the engagement was carried out in accordance with the Standard; a title for the report;

- if applicable, a statement to the effect that the member is not independent of the client in terms of the identification of the assembled financial information, and if applicable, a notation to the effect that it is based on the financial information that was provided by the client;

- the foundation of any information on the prognosis as well as the primary assumptions (applicable to prospective financial information only)

- a declaration that the customer is accountable for the information on their finances that was gathered by the member;

- a statement indicating that neither an audit nor a review have been performed, and that there is no assurance expressed on the compiled financial facts;

- a statement indicating that the member is reporting on the compilation of SPFS, as well as a statement indicating the particular purpose for which the SPFS have been prepared, and a statement indicating that the SPFS are only suitable for the purpose for which they have been prepared and may not be suitable for any other purpose;

- the date of the compilation report, the name, address, and signature of the member or firm;

- a liability disclaimer that is appropriate for the situation;

- an explanation of the client's obligations with regard to the compilation engagement as well as the financial information

Refer to the standard for information concerning:

- public interest;

- professional competence and reasonable care;

- confidentiality;

- planning;

- examples of an engagement letter;

- reports compiled together;

- accountant's report disclaimer;

- objectives;

- definitions;

- scope;

- application;

- appropriate regulatory framework for financial reporting;

- documentation and quality control;

- the subsequent gaining of knowledge of the facts;

- the use of decision trees to establish whether or not an engagement is a compilation engagement;

- when it is appropriate to release a compilation report;

- the client is responsible for their actions;

- transmission of materially important information.